Getting My Life Insurance Company To Work

Table of Contents10 Easy Facts About Life Insurance Louisville Ky ShownSome Known Details About Life Insurance Quote Online Some Of Term Life Insurance Louisville8 Easy Facts About Whole Life Insurance Louisville Explained

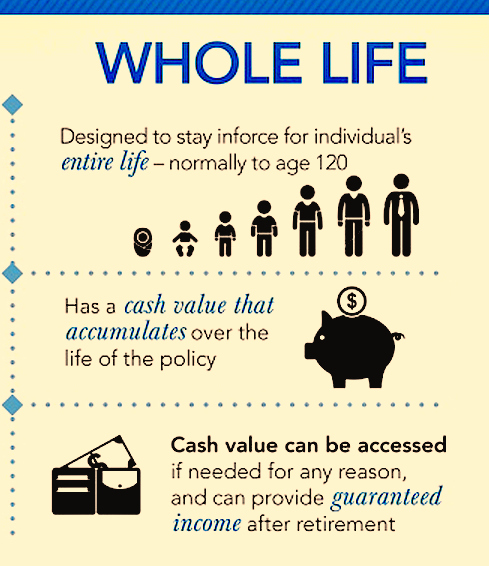

e., supplies and bonds by the federal government. Life insurance policy fundamentals: Terms, protection demands and price, Life insurance policy plans can vary commonly. There's life insurance policy for households, high-risk buyers, couples as well as numerous other details groups. Despite all those differences, many plans have some common features. Here are some life insurance policy fundamentals to assist you better comprehend just how coverage works.For term life plans, these cover the expense of your insurance coverage as well as administrative expenses. With a long-term policy, you'll additionally be able to pay cash right into a cash-value account.

You could desire your costs covered if you're no longer able to work, or perhaps you would love to include a youngster to your plan. By paying for a life insurance policy biker, you can include those as well as other functions to your policy. Who needs life insurance policy? Like all insurance, life insurance was designed to solve a financial problem.

Everything about Term Life Insurance

If you have a partner, kids or any person depending on you financially, they're going to be left without assistance - Life insurance quote online. Even if no person relies on your revenue, there will certainly still be costs connected with your death. That can imply your partner, child or loved ones will have to spend for burial and also other end-of-life costs.

If no one relies on your revenue as well as your funeral service costs won't harm anyone's finances, life insurance policy may be a thing you can skip. If your death will be a monetary concern on your liked ones instantly or in the lengthy term, you might need a life insurance plan.

If you're simply covering end-of-life costs, you won't require as long as if you're trying to change lost earnings. The calculator listed below can aid you approximate just how much life insurance policy you require. If you have an interest in an irreversible plan, link with a fee-only economic advisor. The advisor can help you understand just how a life insurance plan matches your economic plan.

Much healthier individuals are much less likely to pass away quickly, which suggests business can bill them less click to investigate for life insurance. More youthful individuals are likewise much less likely to pass away soon, so life insurance policy is less costly (on average) for more youthful buyers (Life insurance companies near me). Females live longer, nonsmokers live longer, people without complicated clinical problems live much longer, and on and on goes the list.

Life Insurance Louisville Ky - An Overview

The insurance company will inspect your weight, blood stress, cholesterol as well as various other elements to attempt to identify your general health and wellness., yet you'll commonly pay more for insurance coverage. You may likewise be restricted to less coverage than you're really hoping for, with some bigger insurance companies maxing out no-exam plans at $50,000.

Staff member life insurance coverage can frequently cover fundamental end-of-life expenditures and might cover some or all of your annual income. Standard coverage typically does not need an exam and might even be cost-free.

Life insurance is a kind of insurance coverage that pays a recipient in case of the fatality of the guaranteed person. When a plan is purchased, a specific fatality advantage is chosen. Life insurance policy is an agreement between the plan owner and also the insurance company: the plan owner (or policy payer) accepts pay a specified amount called a costs.

Get This Report about Kentucky Farm Bureau

If there are individuals who rely on you monetarily (consisting of kids, a spouse, a business companion, impaired or elderly relatives), having a life insurance coverage plan will protect them when they can no much longer rely on your profits. If you have a mortgage or various other monetary obligations, a life insurance policy can help pay off financial debts and also provide living expenditures to the individuals you call as beneficiaries.

For the majority of people, the need permanently insurance will certainly be greatest after starting a family members and will certainly decrease gradually as youngsters mature as well as end up being independent (Life insurance company). Life insurance policy can assist make certain future requirements are fulfilled and also that your household preserves its criterion of living, no issue what life brings.

Bear in mind to include the future costs of items you wish to pay for such as a home loan or academic costs. Some choices to take into consideration: The length of time will any kids remain in your home and be supported? What are possible education expenses for dependents, whether a kid or a grownup who might require to go into the labor force after the fatality of the key carrier? Do you wish to cover home loan or lorry payback expenses? Some consultants suggest an amount of life insurance coverage that equals or exceeds two to six times the annual income of the insurance holder.

What are various kinds of Life Insurance? The key purpose of life insurance policy is to provide for dependents need to the family members provider pass away.